- Cost Centers

- Project Cards

- Operation Definitions

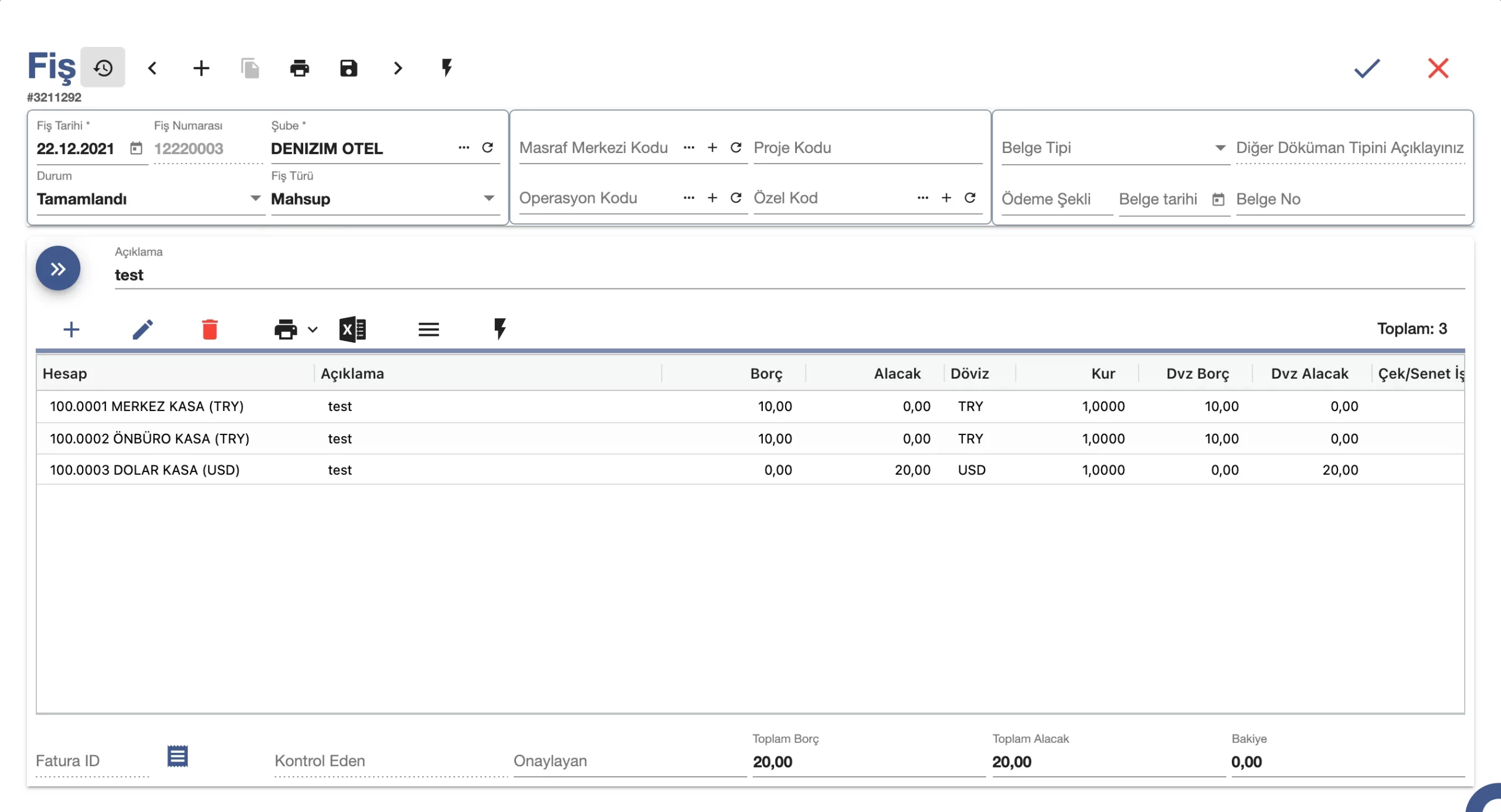

- Chart of Accounts and Foreign Currency Account Tracking

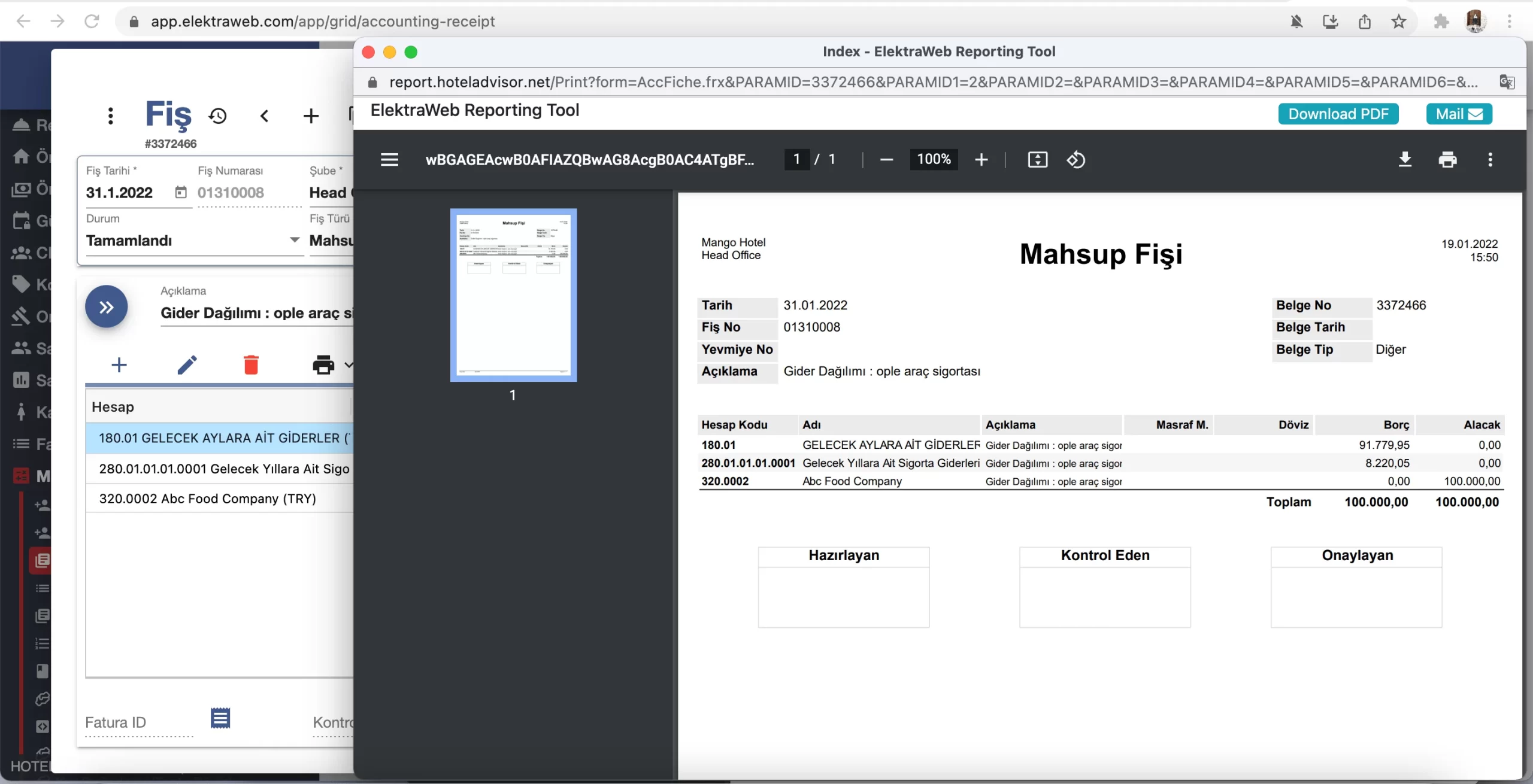

- Accounting Receipts,

- Payment Orders,

- Mizan,

- Deputy,

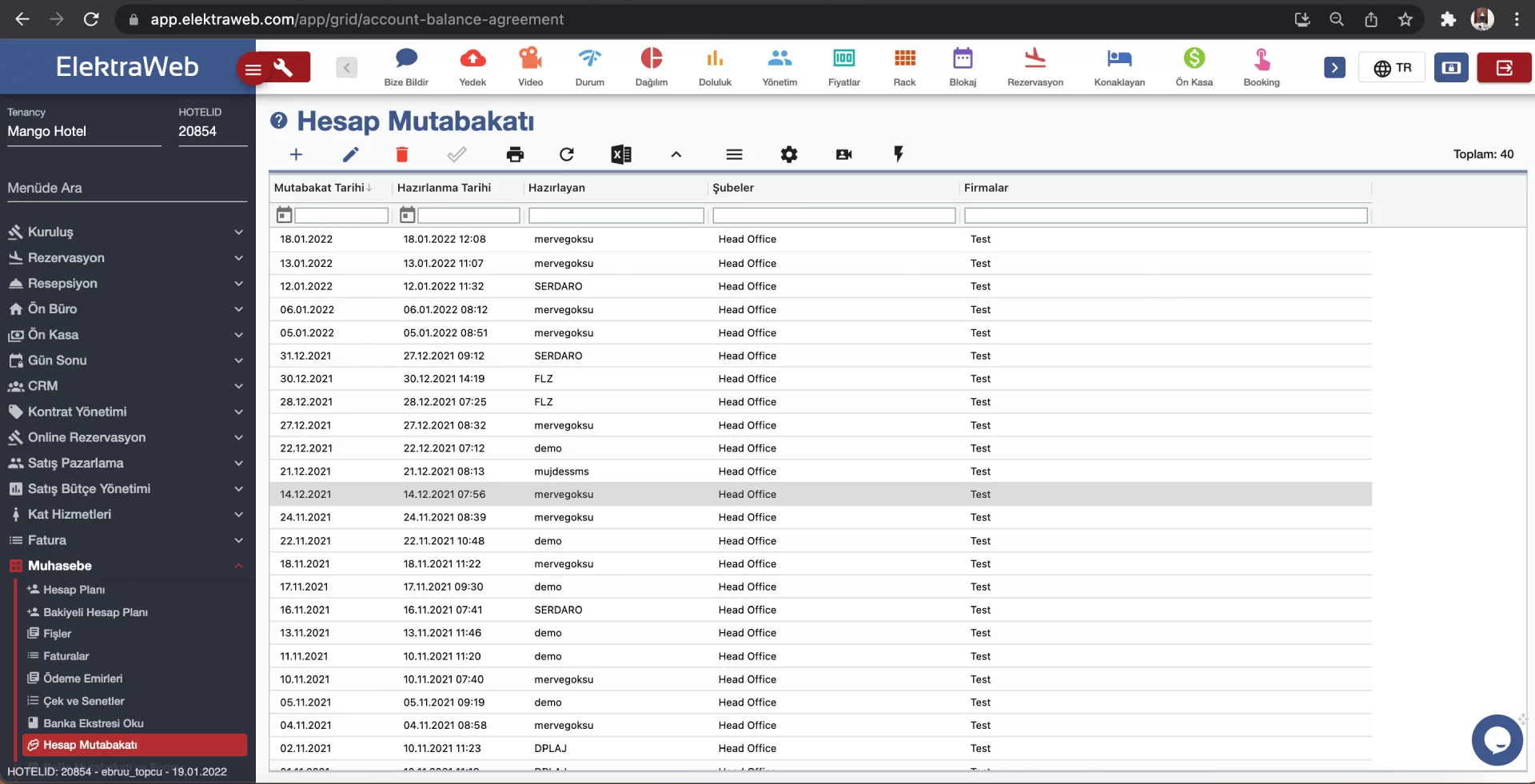

- e-Reconciliations,

- Aging Analysis

- Financial Statements

- Financial Status

- Account Analysis

- Profit/Loss Analysis by Cost Center

- Project Cost Tracking

- Currency Valuation Receipts

- Reflection Receipts

- Check and Promissory Note Module

- Bank Loans Module

- Periodic Costs Module

- Budget Tracking Module

- Automatic Bank Integration Module

- Market Places Integration Module

- Integration API Infrastructure

- E-Ledger Integrations

-

- Front Office Module

- Booking Engine

- Channel Manager

- Sales Project and Banquette Management

- Agency Bonus

- ID and Passport Reading System Kimlikokur

- Hotspot and Logging System

- Call Center Program

- Check-in Kiosk

- Dynamic Pricing

- CRM and Loyalty Management

- Smart Chat

- Reputation Management

- Guest App

- Timesharing Management

- WhatsApp API

- Carbon Balancing

-

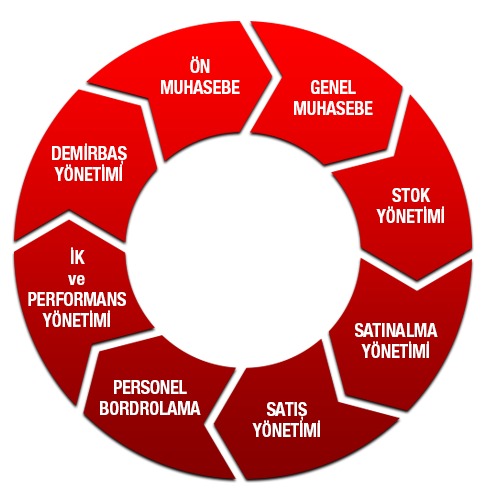

- Accounting Management

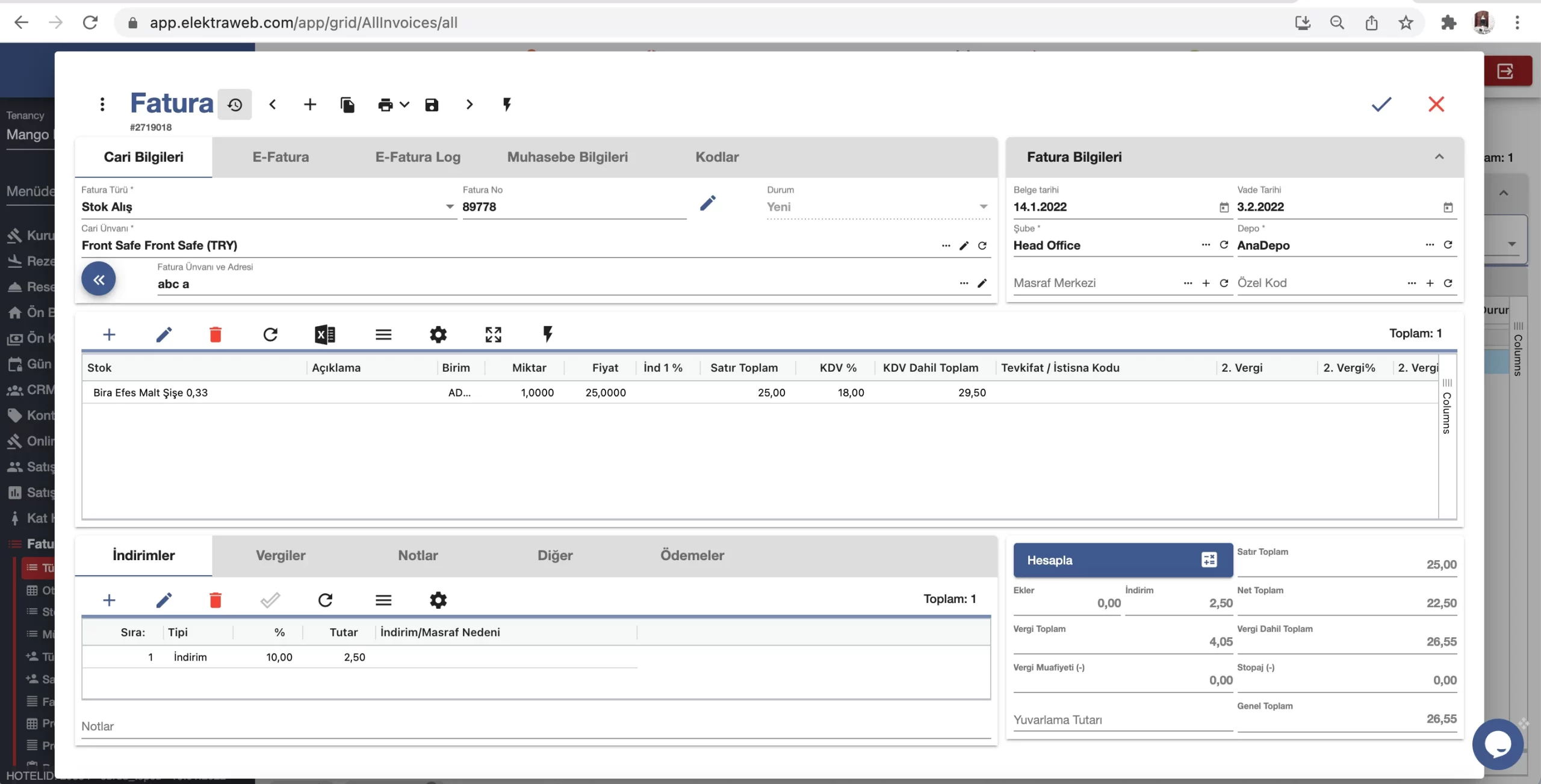

- e-Invoice, e-Archive, e-Waybill

- Inventory Tracking Program

- Fixed Asset Management

- Production and Cos

- Procurement Management

- Stock Tracking Program

- Procurement Management

- Bank Integrations

- Human Resources Management

- HR Portal Mobile Application

- Quality and Document Management System

Free Demo